Not known Facts About Trace Zero

Table of ContentsThe 4-Minute Rule for Trace ZeroGet This Report about Trace ZeroTrace Zero for BeginnersAll about Trace Zero7 Simple Techniques For Trace Zero

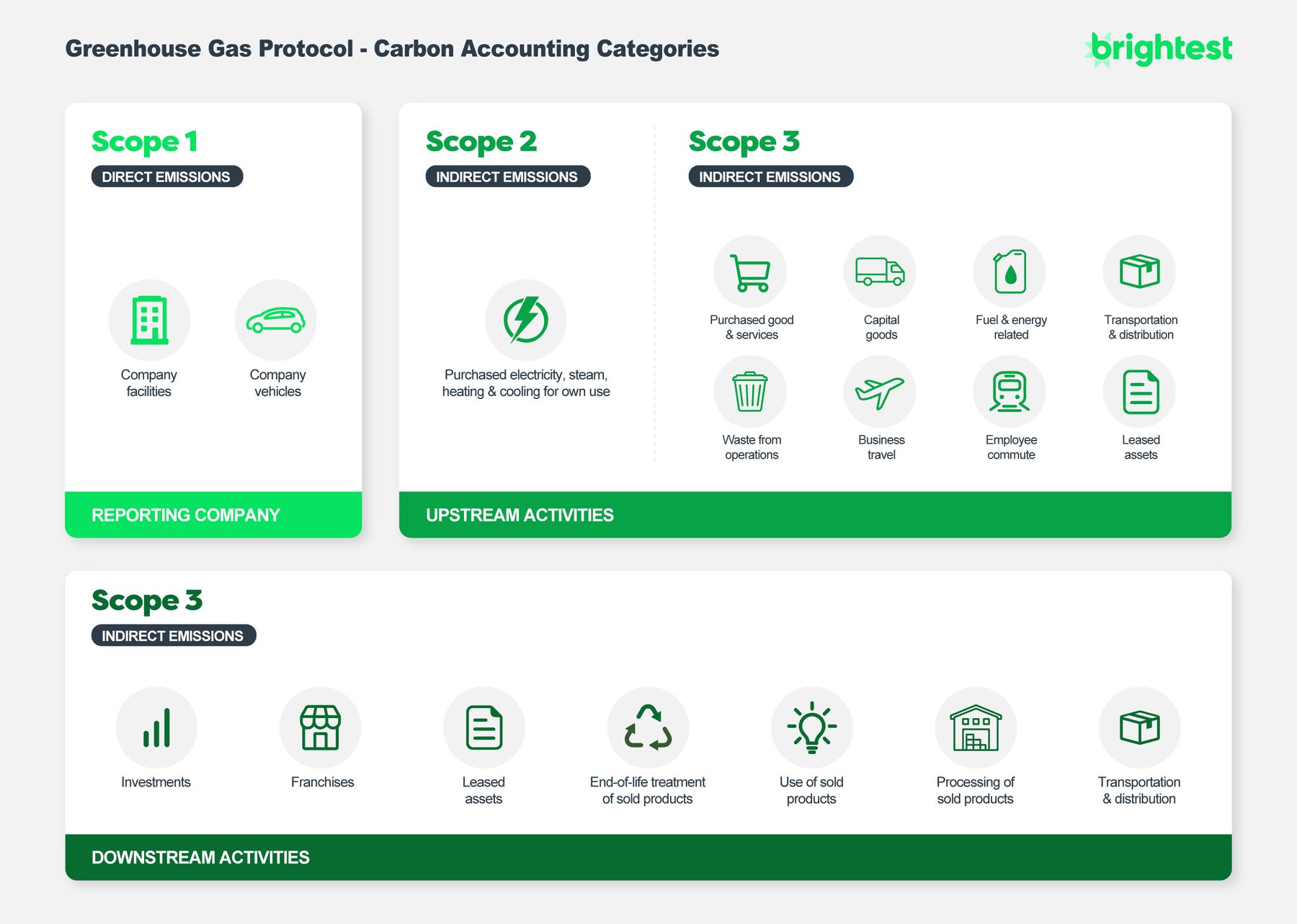

Carbon accountancy makes it possible for organizations to do well in the net-zero shift and handle climate-related dangers. Organizations with durable carbon accounting practices are much better put to fulfill demand from customers, capitalists and regulators (like the EU CBAM and UK CBAM), and can recognize threats and affordable possibilities. There are limitations to carbon accounting if it's not done properly.Organizations require to utilize their carbon accounting information and understandings to take the best steps., and less than half are determining their supply chain emissions.

Residual mix factors resemble grid-average factors yet are calculated based upon electricity created from non-renewable sources, for instance, oil, gas, coal or other resources not backed by EACs. If recurring mix elements are not available for a region, then common grid-average variables need to be made use of, due to the fact that they are in the basic location-based method.

Some Ideas on Trace Zero You Need To Know

Point 5 requires that certificates be sourced from the very same market in which the reporting entity's electricity-consuming operations are situated and to which the tool is applied. This suggests that it would be inaccurate to allot certificates released in the US to intake in the UK (trace carbon solutions). If the organization has power purchase contracts, the certificates might not exist

Baseline-and-credit systems, where baseline discharges degrees are specified for private managed entities and credit reports are issued to entities that have actually reduced their emissions below this level. It is different from an ETS in that the discharge reduction result of a carbon tax obligation is not pre-defined yet the carbon price is. Attributing Mechanisms issue carbon credit ratings according to an accountancy procedure and have their very own computer system registry.

For governments, the choice of carbon prices type is based upon national situations and political truths - trace carbon accounting. In the context of required carbon rates efforts, ETSs and carbon tax obligations are the most common kinds. The most appropriate campaign type depends upon the particular scenarios and context of a provided jurisdiction, and the tool's policy goals ought to be aligned with the broader national financial top priorities and institutional capabilities

Indirect carbon prices campaigns are not presently covered in the State and Patterns of Carbon Prices series and on this website.

9 Simple Techniques For Trace Zero

Carbon bookkeeping actions discharges of all greenhouse gases and consists of CO2, methane, nitrous oxide, and fluorinated gases. Gases other than carbon are shared in terms of carbon matchings.

As an example, in 2012, the UK union government introduced obligatory carbon coverage, calling for around 1,100 of the UK's largest provided business to report their greenhouse gas exhausts every year. Carbon accountancy has because risen in value as more regulations make disclosures of exhausts required. Thus, there is a higher trend in coverage demands and regulations that require business comprehend where and just how much carbon they discharge

ESG frameworks gauge a service's non-financial efficiency in environmental, social and administration categories. Carbon bookkeeping is an important component of the E, 'Atmosphere', in ESG. is a statistics action used to contrast the discharges from numerous greenhouse gases based upon their International warming potential (GWP). GWP determines the loved one strength of various greenhouse gases in capturing heat inside the planet's ambience.

4 Simple Techniques For Trace Zero

A carbon matching is calculated try these out by transforming the GWP of various other gases to the comparable quantity of co2 - trace zero. As pressure climbs to lower discharges and reach enthusiastic decarbonisation objectives, the function of carbon audit is significantly critical to a company's success. In addition to environment pledges and regulative constraints, the rate of carbon is progressively increasing and this more incentivises the private market to determine, track and reduce carbon discharges

Carbon audit allows business to pinpoint where they are releasing the most discharges. Carbon bookkeeping is the very first and crucial action to discharges reduction, which is important if we desire to stay listed below 2 degrees of worldwide warming.